Netspend, founded in 1999, is a prominent provider of prepaid debit cards, prepaid debit MasterCard and Visa cards, and business prepaid card solutions in the United States, serving over 10 million consumers. Netspend dispute forms are quick and easy to complete, Once the dispute is resolved. Netspend will refund you.

What is a Netspend Dispute Form?

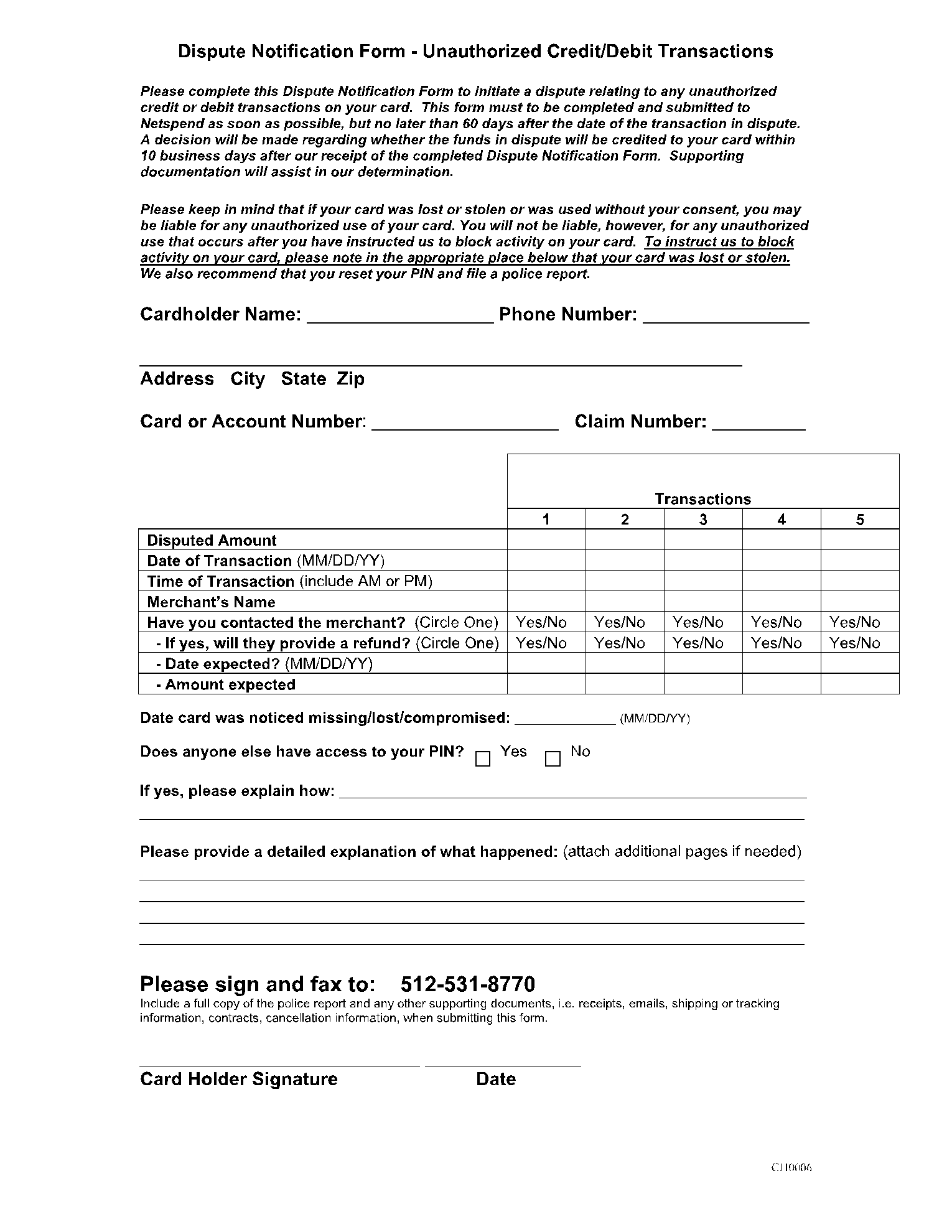

A Netspend dispute form is a document you may submit to Netspend to point out discrepancies on your credit reports and request that the errors be removed. You can explain why you feel the things are incorrect in the dispute form and give any supporting documentation. If your dispute is decided in your favor, Netspend should delete the incorrect information from your file and amend your report.

Information Required on a Netspend Dispute Form

After you call the card company or dispute the charge online, send a dispute form as soon as possible. The dispute form informs the card company of the situation in writing. Remember that you must send the dispute form within 60 calendar days of receiving the first statement on which the disputed charge appears.

A Netspend Dispute Form include the following information

- Current date

- Your details (name, contact info, date of birth, and account number) contact information for the credit bureau

- A simple explanation of the problem (no need to regale them with a long and complicated story)

- Any documents you may have that will assist establish your position, such as payment records or court papers (including a note in the dispute form stating that you are providing them)

- Instructions to the credit bureau on what you want them to do (reinvestigate and remove the item from your report)

- A copy of your credit report that includes the inaccuracy identified

- A scanned copy of your government-issued ID (such as your driver's license) and a bill or other proof of address

How to Fill Out a Netspend Dispute Form?

The credit Netspend Dispute Form might influence whether your complaint is handled seriously or tossed into the frivolous bin. The following step should serve as a guide in writing a Netspend dispute form.

1. Send the dispute form within two months of receiving it.

The federal law will back you up when you file a dispute, but you must do it within two months of receiving your bill. As a result, be certain that the form is written and sent on time.

2. Start at the top with the date and address.

Put the date on the page in the upper left-hand corner. Put a line break between your name and address and the date. Along with your address, include your account number. Insert another line break, followed by the address of the credit card business. You should email it to your credit card company's billing inquiries address, noting "Billing Inquiries" under the company's name.

3. Include a greeting.

This form will be more difficult to address than a usual letter. As a result, address it as "Dear Sir or Madam:" followed by a colon.

4. Provide specifics about the dispute.

Begin by explaining why you are writing. Indicate the amount of the disagreement, the date you were billed, the date it was released (if it was pending), and the firm that charged it.

You may, for example, write: "I am writing to complain because Netspend debited my account twice for $122.14 on January 27, 2015, and the money was officially deducted from my account on January 29, 2015. Only one of the charges should be on my bill, and I would want to dispute the other."

5. Provide a charge description.

Provide a full description of what was purchased if possible. If the charge was fully fraudulent (someone took your card), you may not be able to finish this step, but supply as much information as possible.

You may, for example, write, "I did buy a single pair of boots at the stated price on the day in question. My card was, nevertheless, charged twice."

6. Include proof.

Include the same information as in the dispute form, such as a copy of your credit card billing statement and a copy of your receipt. You should also include a copy of the dispute form you submitted to the company. Do not forget to include a brief description of what you include in your dispute form.

7. Conclude with a specific recommendation for the firm.

You must again specify what the organization should do with the information you are supplying. You do not want them to be perplexed about what you are after.

For example, "I would like this charge investigated, and I expect it to be deleted from my credit card account."

8. Finish with a strong statement.

With a comma at the bottom, put "Sincerely" Insert a line break here (for your signature), put your name, and sign.

9. Duplicate the form.

You will need proof of when you sent the form and what was in it. Make a copy for yourself.

10. Use certified mail to deliver it.

On the other hand, sending it this manner ensures that someone must sign for it. Netspend cannot claim they did not receive your mail this way.

Who Should Use a Netspend Dispute Form?

The Fair Credit Billing Act allows you to dispute credit card charges with your issuer for three reasons:

-

- Someone else used your credit card without your consent. Assume a fraudster charged a large-screen television to your credit card. You have the option of disputing the payment as an unlawful purchase.

- There was a billing mistake. Assume the shop charged you for two TVs, but you only purchased one. You might potentially challenge that accusation.

- You have made a good-faith attempt to work with the merchant to fix a problem. Assume you purchased television and noticed that the screen was cracked. If the merchant refuses to offer you a refund, you should be able to legally challenge that transaction if it meets specific standards under the law.

It is simple to file a dispute. You may only need to complete a few questions and click the "dispute" button on your issuer's web portal or app. The purchase is promptly reimbursed back to you.

Other Netspend Dispute Form Resources

The Following are additional sources to learn more about the NetSpend dispute form.